Financially Sound

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

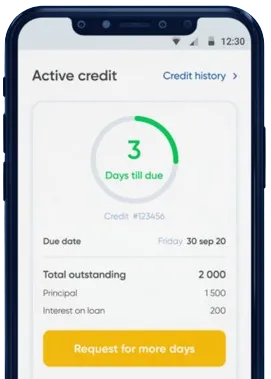

Place your request via our app, just by filling out the form.

Expect a decision in as little as 15 minutes.

Accept your funds, normally transferred in about one minute.

Place your request via our app, just by filling out the form.

Download loan app

In Nigeria, the need for quick and accessible financial assistance is paramount for many individuals and businesses. This is where urgent loans come into play, offering a lifeline to those in need of immediate cash flow. One such option is the urgent loan of 50,000 Naira, which has gained popularity due to its flexibility and convenience.

One of the main advantages of an urgent loan 50,000 in Nigeria is its convenience. The application process is usually quick and straightforward, with minimal documentation required. This means that borrowers can access the funds they need in a timely manner, without the hassle of lengthy approval processes.

Whether you need to cover unexpected expenses, pay off a debt, or invest in a business opportunity, an urgent loan of 50,000 Naira can provide the financial support you need when you need it most.

Another benefit of urgent loans in Nigeria is their flexibility. Borrowers have the freedom to use the funds for various purposes, depending on their individual needs and priorities. Whether it's for personal expenses, medical emergencies, education costs, or any other pressing financial need, an urgent loan can offer a viable solution.

Additionally, urgent loans are available to individuals with varying credit scores, making them accessible to a wider range of borrowers. This means that even those with less-than-perfect credit history can still qualify for a loan, enabling them to address their financial challenges effectively.

When considering urgent loans in Nigeria, it's important to note that interest rates can vary among lenders. However, many providers offer competitive rates to attract borrowers and ensure affordability. By comparing different loan offers, borrowers can find a deal that suits their budget and repayment capabilities, ultimately making the borrowing process more manageable.

With the rise of digital lending platforms, applying for an urgent loan 50,000 in Nigeria has never been easier. Online applications allow borrowers to complete the entire process from the comfort of their homes, eliminating the need for in-person visits to financial institutions. This level of convenience saves time and streamlines the borrowing experience, making it more accessible to a wider audience.

In conclusion, urgent loans of 50,000 Naira in Nigeria offer a range of benefits to borrowers in need of quick financial assistance. From convenience and flexibility to competitive interest rates and online applications, these loans provide a practical solution to urgent financial needs. By understanding the advantages of urgent loans, borrowers can make informed decisions and access the funds they need in a timely manner.

An urgent loan of 50,000 in Nigeria is a type of short-term loan that is typically disbursed quickly to individuals who are in urgent need of funds.

Individuals who are Nigerian citizens, above 18 years of age, and have a regular source of income are typically eligible to apply for an urgent loan of 50,000 in Nigeria.

Repayment terms for an urgent loan of 50,000 in Nigeria vary depending on the lender, but they generally range from a few weeks to a few months.

Many lenders offering urgent loans of 50,000 in Nigeria aim to disburse the funds within 24 hours of approval.

Typically, you will need to provide proof of identity, proof of income, and bank statements when applying for an urgent loan of 50,000 in Nigeria.

If you are unable to repay the loan on time, you may incur late fees or interest charges. It is important to communicate with your lender if you anticipate any issues with repayment.